OFFER FOR APPOINTMENT AS AGENCIES FOR SPECIALISED MONITORING (ASM)

Public Notice - Trade Relief Measures for Eligible Borrowers

Application for Empanelement of recoveries agencies

Extension of timeline for submission of applications for empanelment of Technical Partners/Agency for Techno-Economic Viability (TEV) Consultants/Lenders’ Independent Engineers (LIE)

PUBLIC NOTICE FOR EMPANELMENT OF TECHNO-ECONOMIC VIABILITY (TEV) STUDIES AND SERVE AS LENDERS’ INDEPENDENT ENGINEERS (LIE)-2025-26

Bank has extended the validity period for the empanelment of existing TEV / LIE agencies upto 31.12.2024. Accordingly, the services of the currently empaneled TEV/LIE agencies in the Bank may continue to be utilized by all branches until December 31, 2024.

Revised Procedure for making e-payment of Central Excise and Service Tax Arrears under the new CBIC- GST Integrated portal

List of wilful defaulter

List of Cash@POS Merchant

Branch Timings

Inviting Expression of Interest for acting as Judicial Member and Banker Member of Bank's Independent Settlement Advisory Committee (ISAC)

EOI for empanelment of Insolvency Professional Entities(IPEs)

EOI for empanelment of Detective Agency Download:Application Form

In case any instructions is not received from the customer, even after giving notice, the deposit will be renewed, excluding deposits like PSB Fixed Deposit Tax Saver Scheme, Capital gain deposit, Bulk Deposit, Inter Bank Deposit, Online fixed Deposits and Deposits under lien, for the same period of time as the matured deposit at the prevailing rate of interest.The auto renewal of such deposits will be applicable up to the maturity value less than Rs. 1 crore.

The above amended guidelines with regard to automatic renewal of fixed deposits will be applicable to only FDRs maturing on or after the date (i.e 25.01.2017) of implementing above amended guidelines. The FDRs maturing before the date (i.e 25.01.2017) of its implementation shall be dealt as per existing guidelines contained in Para No.12 of Deposit Policy of the Bank vide HO P&D Circular No. 3414 dated 24.02.2017 i.e. guidelines prevailing before the date of implementing above amended guidelines.

Dos & Don’ts for Customers on use of Debit Cards

Dear Customers

Please register your mobile number with the Bank for SMS Alerts, if not done already.

- Please inform the Bank in writing immediately in case your mobile number registered for SMS alert is changed.

- Don’t write the PIN Number on the Card or anywhere else. Please memorize the same.

- Please change your Pin/Password periodically for security reasons.

- Never share Card details, PIN, CVV, OTP etc. with anyone. Bank does not call for such information from any Customer. Therefore, no information should be shared on telephone also even if the person calling from other end introduces himself as Bank official.

- In case your Debit Card is non-functional for any reason, please contact the Customer Care

- Please do not leave your mobile with others

- Please go through the transactional alerts sent by the Bank through SMS and take up immediately with your Branch in case of any discrepancy.

- Always, please keep your Debit Card safely in your possession.

- Emergency numbers :- Please contact on following numbers:

Call Centre : All India Toll Free Numbers:1800-419-8300

For Hot Listing (Blocking) :(By SMS) 9223815844

All the customers of Punjab & Sind Bank are hereby informed that the Bank has amended the guidelines in Deposit policy with respect to payment of interest on Overdue FDRs and these are as under:-

- Renewal of Fixed Deposit on the date of Maturity : When a term deposit is renewed on maturity, interest rate for the period specified by the depositor as applicable on the date of maturity would be applied. Accordingly where Bank has the mandate for automatic renewal, the FDR will be renewed for an identical period on its due date at the interest rate applicable on the date of maturity for the period it is renewed.

- Renewal of Term Deposit within 14 days of Maturity : If any customer approaches the Bank for renewal of Fixed Deposit within 14 days of the date of its maturity, the FDR shall be renewed from its date of maturity at rate of interest applicable on the date of maturity for the period for which FDR is renewed.

- Renewal of Term Deposit after 14 days of Maturity : Where overdue period i.e. from the date of maturity till the date of renewal (both days inclusive) exceed 14 days, such overdue term deposits shall be renewed with effect from the date of presentation for a minimum period of 15 days or more as specified by the depositor beyond the date of presentation and Interest for the overdue period shall be paid on the amount being renewed (equal to or less than the Maturity Value of the Original Deposit) at Savings Bank rate of interest as applicable from time to time, presently being 4% on the methodology as applicable to Saving Bank account from time to time.

- If such renewed overdue domestic term deposit is tendered for premature encashment, rate of interest would be payable for the period for which the FDR has run from date of renewal subject to penal interest, wherever applicable, from time to time.

- These guidelines are applicable to all Overdue FDRs, irrespective of the date of becoming ODFD i.e whether these FDRs have become overdue “before 06.04.2015” or “on or after 06.04.2015”.

- Non – Renewal / Closure of Overdue Term Deposit : If the term deposit is not renewed but encashed after the date of maturity, the overdue interest will be paid at prevailing Saving Bank rate applicable from time to time for the overdue period (from the date of maturity till the date of payment)."

Public Notice

Kind Attention of all The Esteemed Savings Bank/Current Account Holders of the Bank.

- PUBLIC NOTICE:

Dear Valued Customers, We regret to inform you that some of our ATMs are currently unavailable due to unforeseen circumstances. We sincerely apologize for any inconvenience this may cause.

For your transactions, we kindly request you to visit our nearest branch teller or any alternative Punjab & Sind Bank ATM in your vicinity.

Thank you for banking with us. Punjab & Sind Bank

- PUBLIC NOTICE:

It is hereby to inform all general public and valued customers of Punjab &Sind Bank that Punjab & Sind Bank, Zonal Office, Guwahati located at 42, M.G. Road, Uzan Bazar, Guwahatihas shifted to new location and will start functioning from our New Office at Sethi Trust Building, 4th Floor, 2nd Unit, Bhangagarh, Guwahati, Assam-781005 from 12.05.2025.

All the customers and general public are requested to take note and visit our New Office for any Banking related services w.e.f 12.05.2025.

For any further clarification/query contact: zo[dot]guwahati[at]psb[dot]co[dot]in and +91-7896536440 during office hours from 10.00 AM to 5.00 PM over phone or in person. Zonal Manager

- Notice to customers for replacement of old ATM Proprietary Magnetic stripe cards

- Removal of duplicate Customer IDs (allotment of unique customer code)

- Dear Customer, PSB has begun Mobile Banking. Please register your mobile number with your PSB branch

- All the customers of Punjab & Sind Bank are hereby informed that Reserve Bank of India has decided to implement CTS – 2010 Standard Cheque Forms across the country w.e.f. 01.10.2012. Customers are therefore requested to check their existing cheque books and if it is not CTS - 2010 Standard, Please visit to your respective branch, return the same and obtain new Cheque Books having CTS - 2010 Standard features. For more details please contact your branch.

- Customers who have not operated their accounts for more than 2 years are requested to visit to their respective branches along with KYC documents including identity proof and and recent passport size photograph for activation of the accounts. Please note there will be no charse for activation.

- As per RBI Directions, All the customers of our Bank are requested to contact their respective branches and get the KYC documents i.e photograph/s, Identity and address proof updated.

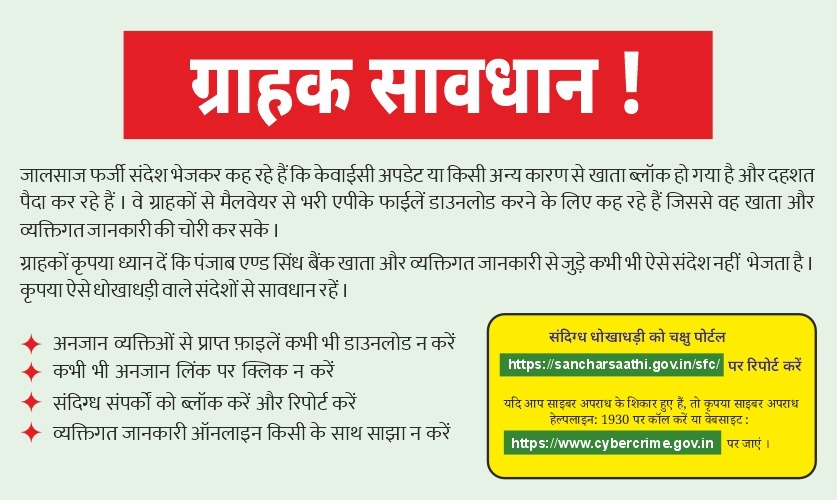

Beware of fictitious offers of lottery /money winning/remittances of cheep funds in foreign currency from abroad